0.1, 0.5, or 1 BTC: How Long Does It Take on an Average Salary

Let’s start with a number most people don’t expect:

The “average” full-time American (median) saves about $57 per week. That comes straight from combining median weekly earnings ($1,214/week) with the personal saving rate (4.7%) reported in official U.S. data.

Now the punchline:

If you put all ~$57/week into BTC (Bitcoin), a simple long-term “Bitcoin Power Law Style” trend model suggests ~10 years to reach 0.1 BTC (Bitcoin).

If you put half of that (≈$28/week), that same model says you’ll likely never reach 0.1 BTC (Bitcoin) with a flat weekly budget (you hit a ceiling below it).

If your goal is 0.5 BTC (Bitcoin) or 1 BTC (Bitcoin), the model implies you’ll need a plan that ramps up over time—not a “set it and forget it” $20/week habit.

This isn’t hype. It’s what happens when you combine normal savings behavior with the idea that Bitcoin gets harder to buy as it trends upward.

If you want the full reasoning (and how to plug in your numbers), keep reading.

Part 1 — The baseline: what “average salary” and “average saving” mean

To avoid fantasy math, we’ll anchor to official U.S. data:

Median weekly earnings for full-time wage and salary workers: $1,214/week (Q3 2025) from BLS (Bureau of Labor Statistics).

Personal saving rate: 4.7% (September 2025) from BEA (Bureau of Economic Analysis).

Quick conversion:

Annual income baseline ≈ $1,214 × 52 = $63,128/year

Weekly savings baseline ≈ $1,214 × 4.7% = ~$57/week

That $57/week is the “fuel” most people actually have—before we even talk about Bitcoin.

Part 2 — The realistic move: people don’t buy BTC from income… they buy it from savings!

Here’s the honest question:

What percentage of your savings would a normal person really allocate to BTC (Bitcoin)?

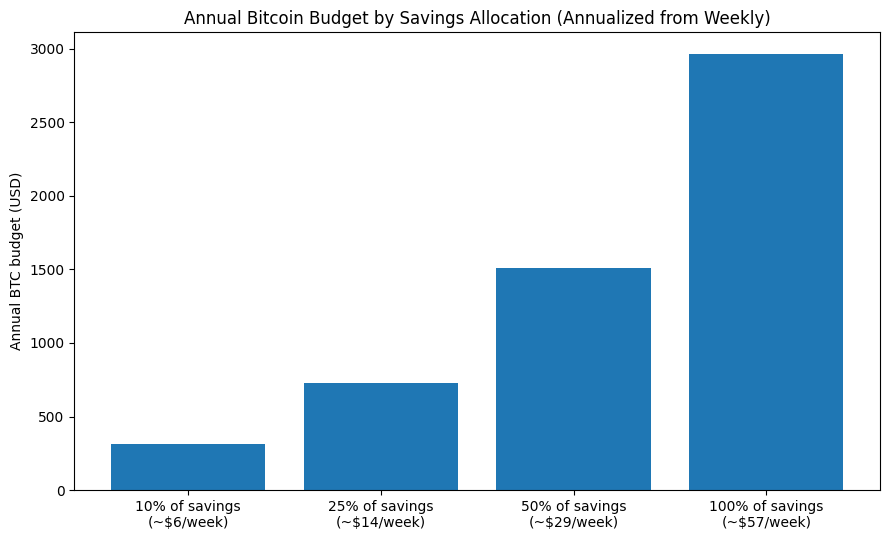

So we’ll test four behaviors (as a fraction of savings):

10% of savings → BTC (Bitcoin): about $6/week

25% of savings → BTC (Bitcoin): about $14/week

50% of savings → BTC (Bitcoin): about $29/week

100% of savings → BTC (Bitcoin): about $57/week

No fantasies. Just human behavior.

Part 3 — The price anchor (so the math is reproducible)

As of January 17, 2026, BTC (Bitcoin) is about $95,000.

Bitcoin Jan 2026

If you read this later, swap in today’s price. The method still works.

Part 4 — Two ways to estimate “years to 0.1 / 0.5 / 1 BTC”

We’ll use two models on purpose:

Model A: Flat-price baseline (optimistic lower bound)

This asks: “If BTC (Bitcoin) stayed at the same price forever, how long would it take?”

It’s not realistic, but it gives you a best-case lower bound.

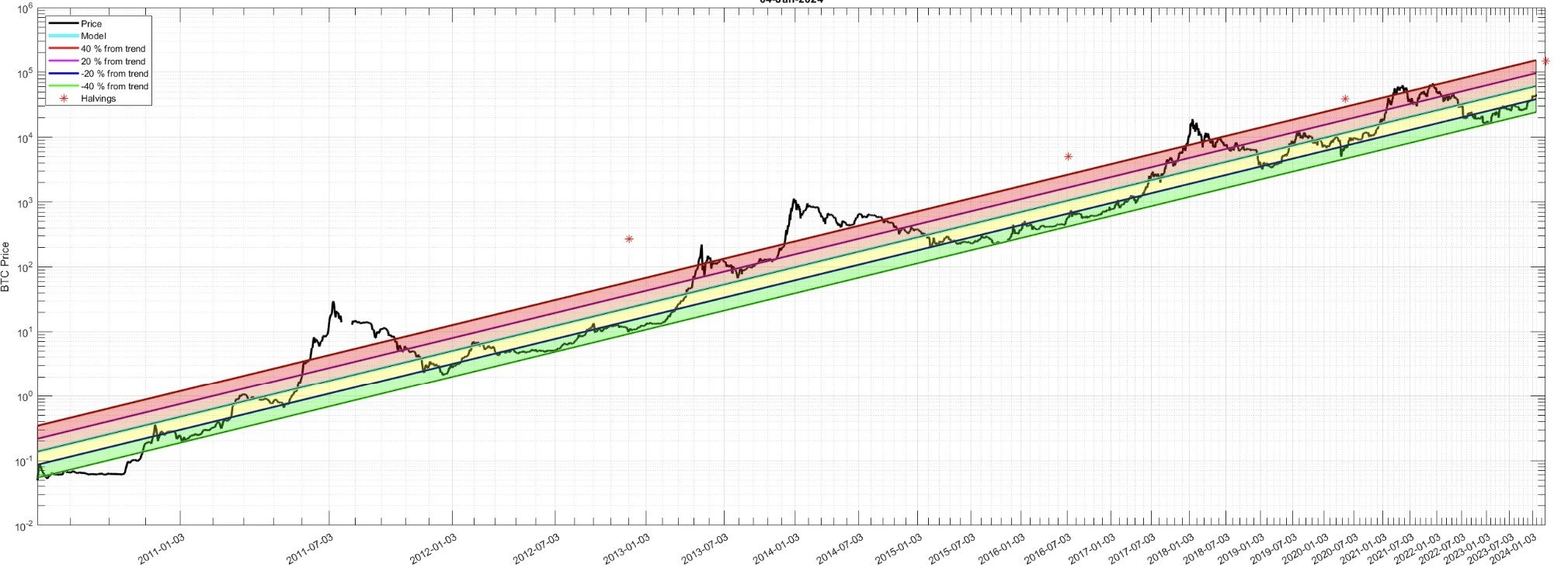

Model B: Bitcoin Power Law trend (the “waiting penalty” model)

A commonly cited Bitcoin Power Law form in Bitcoin discussion looks like:

Estimated Price = A × (days since the Genesis Block)^n

Important engineering note:

This is a curve fit idea—useful for intuition, not a guarantee.

We’ll use it for one purpose only:

To quantify why “starting later” can mean your same dollars buy fewer sats (satoshis).

Bitcoin Pawer Law

Part 5 — The timelines (finally): how long to reach 0.1 / 0.5 / 1 BTC

First: the optimistic baseline (flat price)

If BTC (Bitcoin) stayed at ~$95k forever:

$57/week (100% of average savings)

0.1 BTC (Bitcoin): ~3.2 years

0.5 BTC (Bitcoin): ~16.1 years

1.0 BTC (Bitcoin): ~32.1 years

$29/week (50% of average savings)

0.1 BTC (Bitcoin): ~6.4 years

0.5 BTC (Bitcoin): ~32.1 years

1.0 BTC (Bitcoin): ~64.2 years

That’s the “nothing gets harder” world.

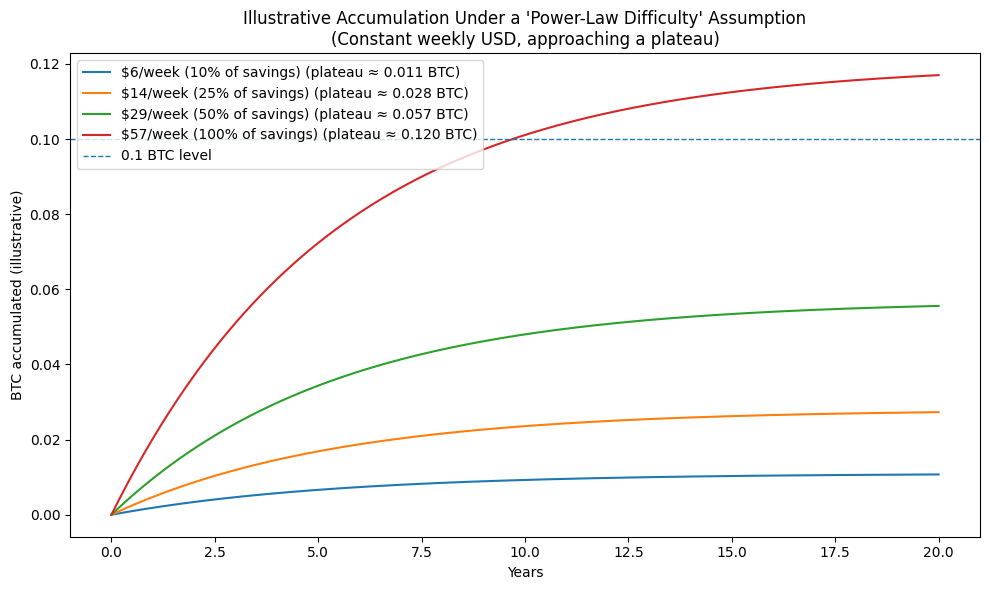

Now: the Bitcoin Power Law reality check (the waiting penalty)

If BTC (Bitcoin) follows a long-term trend shaped like a Bitcoin Power Law, constant weekly dollars behave differently:

$57/week (100% of average savings)

0.1 BTC (Bitcoin): ~9.7 years

0.5 BTC (Bitcoin): not reachable with a flat $57/week (you plateau below it)

1.0 BTC (Bitcoin): not reachable with a flat $57/week (you plateau below it)

$29/week (50% of average savings)

You plateau around ~0.057 BTC (Bitcoin) and never hit 0.1 BTC (Bitcoin)

$14/week (25% of average savings)

You plateau around ~0.028 BTC (Bitcoin)

$6/week (10% of average savings)

You plateau around ~0.011 BTC (Bitcoin)

That “plateau” is the core message:

If price trends up faster than your weekly input grows, your progress slows and can cap out.

Part 6 — “Okay… so what does a 5-year plan look like?”

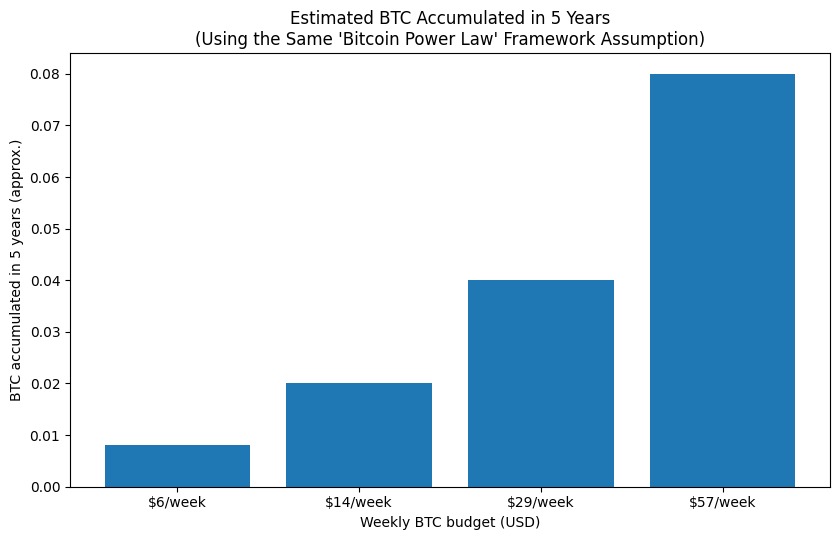

Using the same Bitcoin Power Law framework, here’s what the average saver accumulates in 5 years:

$6/week → ~0.008 BTC (Bitcoin)

$14/week → ~0.020 BTC (Bitcoin)

$29/week → ~0.040 BTC (Bitcoin)

$57/week → ~0.080 BTC (Bitcoin)

Read that carefully: $57/week for five years gets you close to 0.1 BTC (Bitcoin)—but not quite—in the “harder” model.

This is exactly why people feel like Bitcoin keeps “running away.”

Part 7 — The fix: don’t keep your weekly buy flat

Here’s the good news: the “plateau problem” is mostly self-inflicted.

Most people don’t keep their contribution flat in real life. They get raises, change jobs, cut expenses, add side income, or redirect one big annual chunk (tax refund, bonus, overtime).

So instead of a flat plan, you build a step-up plan:

Start with a number you can keep (even if small)

Then raise the weekly buy as your income rises (or as you optimize spending)

That one change breaks the plateau

This is how “average people” hit non-average outcomes.

Part 8 — Why waiting makes it harder (in one sentence)

If BTC (Bitcoin) trends upward over time, your dollars convert into fewer sats (satoshis) later—so delaying forces you to “run faster just to stay in place.”

1 BTC isn’t the point—not getting left behind is.

For a typical American household, reaching a full 1 BTC (Bitcoin) is starting to feel like trying to buy an entire beachfront property with a normal paycheck. Not because people are lazy—but because Bitcoin is built to be scarce, and scarcity changes the game.

From an engineering perspective, this is what’s happening:

The “system” has a fixed supply schedule.

Demand comes in waves.

And as the long-term trend rises, each dollar tends to convert into fewer sats (satoshis) over time.

That creates a quiet truth most people don’t want to hear:

waiting doesn’t keep you neutral — it raises the difficulty.

You end up needing to “run faster just to stay in place,” because the same weekly habit buys less Bitcoin later.

But here’s the philosophical part—and it matters:

You don’t need 1 BTC to benefit from Bitcoin.

You need a clear plan, consistency, and time.

Think of Bitcoin like a measuring tool for purchasing power. Even a fraction—0.01, 0.05, 0.1 BTC—can represent years of disciplined accumulation in a system where the rules aren’t negotiable. In a world where most savings vehicles are engineered to leak value through inflation, Bitcoin is engineered to do the opposite: it rewards patience and punishes procrastination.

So the goal isn’t a perfect number.

The goal is to avoid the moment, years from now, when you realize:

“I understood it… I just didn’t start.”

If you want to go deeper, we can help you build a realistic accumulation roadmap based on your cashflow—and set up safe self-custody step-by-step, so you’re not guessing, not improvising, and not leaving your future to luck.

Learn the math of bitcoin

And most importantly: safe self-custody setup, done correctly

Contact Bitcoin Consulting LLC: www.BitcoinConsultingUSA.com